Litecoin: The Digital Silver the Market Forgot

In a world driven by hype cycles and fast-moving crypto narratives, Litecoin often gets overlooked. Launched in 2011 as the “silver to Bitcoin’s gold,” it quietly continues to run, process transactions, and secure value with no fanfare. While newer coins promise innovation, Litecoin offers something rarer: longevity, simplicity, and trustless reliability.

This article presents a contrarian view:

Litecoin is not dead — it’s simply two cycles behind in being properly recognized.

And that delay may offer one of the clearest asymmetric opportunities in the market today.

Litecoin’s Timing Problem — Not a Fundamental One

Bitcoin took over a decade to gain serious institutional interest. Prior to 2020, it was still dismissed as volatile, speculative, and niche. It wasn’t until ETFs, corporate treasuries, and macro hedge funds stepped in that Bitcoin’s narrative flipped from “crypto” to “digital gold.”

Litecoin may be following the same slow path. Despite being live and functional for over 14 years, Litecoin has had little institutional support. But it still shares the same core attributes that make Bitcoin valuable:

- It is decentralized.

- It has a fixed supply (84 million).

- It uses proof-of-work.

- It reduces issuance via a halving schedule every 4 years.

The only thing missing is recognition. And if history repeats, that recognition may arrive suddenly — and reward those who were early.

Halving Cycles: A Critical Link

Litecoin’s major peaks in 2017 and 2021 didn’t align with its own halving events. Instead, they coincided with Bitcoin’s halving-driven bull markets. This shows Litecoin’s price cycle is primarily influenced by Bitcoin’s liquidity cycles rather than its own issuance cuts. Recognition for Litecoin, therefore, is likely to arrive on Bitcoin’s timetable — not Litecoin’s.

A Proven Price History — and a Compressed Valuation

In December 2017, Litecoin reached an all-time high of over $410 — without any institutional help, ETF flows, or favorable regulation. That’s proof of its ability to perform purely on retail demand.

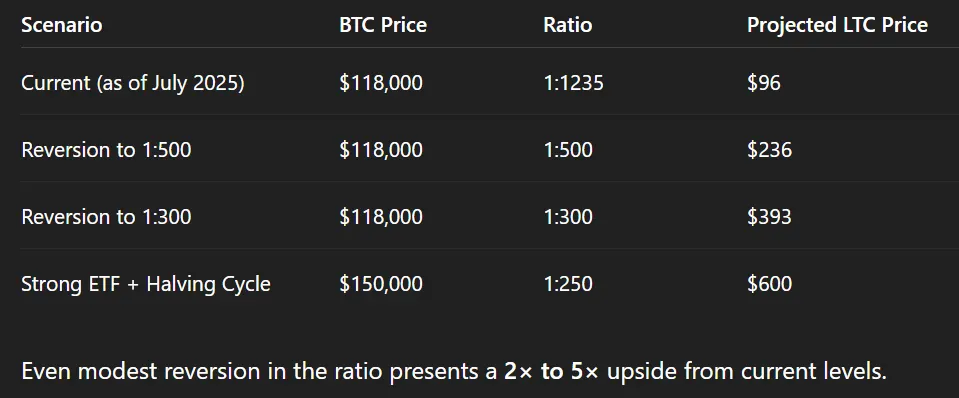

As of July 2025, Litecoin trades near $96, while Bitcoin has crossed $118,000. That puts the BTC:LTC price ratio near 1:1,235 — far higher than the historical range of 1:300–500 during previous bull cycles.

Even a partial reversion to older ratios would imply major upside for Litecoin. This isn’t about outperforming other coins — it’s about returning to a fair historical relationship, which alone could mean 3x–5x returns.

Halving in 2027: The Quiet Supply Squeeze

Litecoin’s next halving is scheduled for September 2027. That’s when new supply will once again be cut in half, reducing miner rewards and creating a long-term supply shock — just like Bitcoin.

Historically, Litecoin has seen strong performance following halving events, but like Bitcoin, the effect is usually delayed. With 2027’s halving landing at the tail end of this cycle, Litecoin could benefit from both:

- The supply squeeze, and

- The late-cycle demand rotation into older, safer assets.

A New Political and Regulatory Backdrop

The United States is shifting its stance on crypto. With the Trump administration showing strong support for:

- Proof-of-Work mining

- Self-custody

- U.S.-led crypto innovation

…Litecoin, like Bitcoin, is well-positioned. It’s not a smart contract platform. It’s not dependent on apps or developers. It’s simply a decentralized, non-corporate digital asset with a 14-year uptime history. If the U.S. begins classifying digital commodities as strategic assets, Litecoin may benefit from that by default.

ETF Potential — Not Needed, But Powerful

Litecoin is already part of Grayscale’s LTC Trust, and it has been treated like a commodity in some legal contexts. A spot LTC ETF is not confirmed — but it’s far from impossible. And unlike newer coins, Litecoin doesn’t face major regulatory battles or token allocation issues.

Even modest ETF inflows could move LTC significantly. That’s because most LTC is tightly held, with low on-exchange supply and a large share sitting in dormant wallets. It wouldn’t take much to tip the market.

Litecoin Is Not Competing With Ethereum or Solana

And it doesn’t need to. Smart contract platforms are like tech stocks — full of innovation, but also full of risk and turnover. New winners emerge every year. But commodities like Bitcoin or Litecoin don’t need to constantly evolve. Their value lies in being simple, secure, and scarce.

Litecoin won’t win the DeFi war. It doesn’t have to. It’s playing a different game — the money game.

Conclusion: Digital Silver, Deeply Discounted

Litecoin may never match Bitcoin’s status — just as silver will never replace gold. But silver still holds value, especially in times of scarcity, monetary instability, or when gold becomes too expensive to transact.

Right now, Litecoin is:

- Cheap relative to Bitcoin

- Largely ignored by institutions

- Technically sound

- Poised for a halving

- Politically aligned with pro-crypto U.S. leadership

In short: not broken, just waiting.

Final Takeaway

Litecoin is digital silver: deeply discounted, reliable, and overlooked by institutions. Like silver, it does not need to replace gold to be valuable. Its long survival is its strength, and in time, markets reward survival.

Litecoin also does not need to beat hype coins or win the smart contract race. Like silver, it only needs to be recognized for what it already is: a lasting store of value, quietly waiting for the world to rediscover its purpose.